How Stonewell Bookkeeping can Save You Time, Stress, and Money.

Wiki Article

An Unbiased View of Stonewell Bookkeeping

Table of ContentsThe Basic Principles Of Stonewell Bookkeeping Stonewell Bookkeeping for BeginnersFascination About Stonewell BookkeepingStonewell Bookkeeping - An OverviewThe 9-Minute Rule for Stonewell Bookkeeping

Below, we answer the question, how does accounting aid a company? In a feeling, accounting books represent a photo in time, yet just if they are updated commonly.

None of these final thoughts are made in a vacuum as valid numeric details must strengthen the economic choices of every small service. Such data is put together with bookkeeping.

You know the funds that are offered and where they drop short. The information is not constantly good, but at the very least you know it.

The Stonewell Bookkeeping Ideas

The labyrinth of deductions, credit scores, exceptions, timetables, and, obviously, penalties, is enough to just give up to the IRS, without a body of well-organized documentation to sustain your claims. This is why a devoted accountant is very useful to a small company and is worth his/her king's ransom.

Your organization return makes insurance claims and representations and the audit focuses on validating them (https://justpaste.it/izep4). Great accounting is all regarding connecting the dots between those representations and truth (business tax filing services). When auditors can comply with the information on a ledger to receipts, bank declarations, and pay stubs, to name a couple of papers, they rapidly discover of the competency and honesty of the company organization

The 25-Second Trick For Stonewell Bookkeeping

Similarly, careless bookkeeping includes in stress and anxiety, it additionally blinds organization proprietor's to the prospective they can realize over time. Without the details to see where you are, you are hard-pressed to establish a location. Just with reasonable, comprehensive, and factual information can an entrepreneur or administration group story a training course for future success.Local business owner recognize finest whether an accountant, accounting professional, or both, is the appropriate service. Both make important contributions to an organization, though they are not the same occupation. Whereas a bookkeeper can gather and arrange the info required to support tax obligation preparation, an accounting professional is better suited to prepare the return itself and really assess the earnings statement.

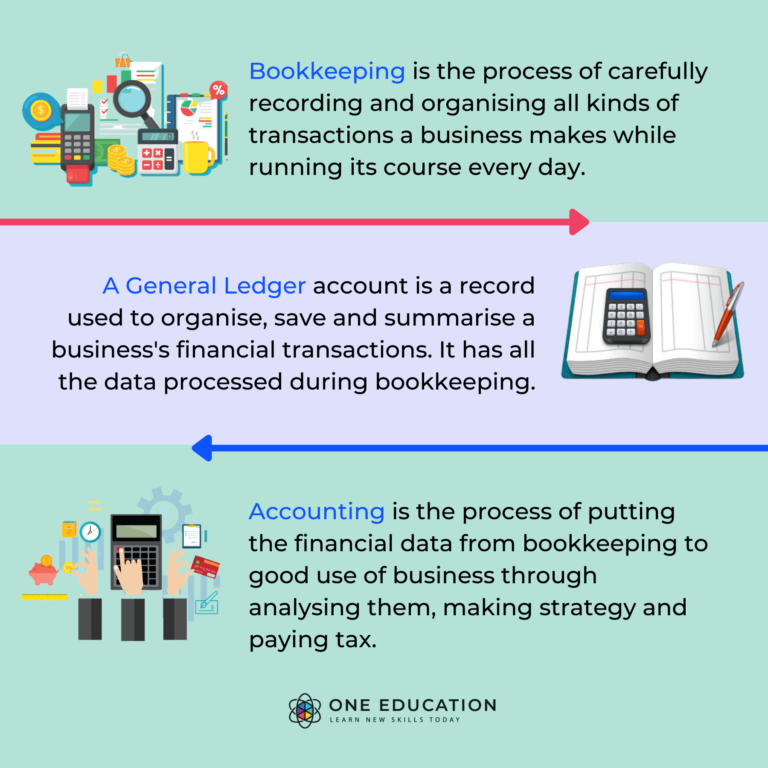

This short article will certainly explore the, including the and exactly how it can profit your organization. We'll likewise cover exactly how to get going with bookkeeping for a sound monetary ground. Accounting involves recording and arranging financial transactions, including sales, acquisitions, repayments, and invoices. It is the process of keeping clear and concise documents to make sure that all monetary details is conveniently accessible when required.

This short article will certainly explore the, including the and exactly how it can profit your organization. We'll likewise cover exactly how to get going with bookkeeping for a sound monetary ground. Accounting involves recording and arranging financial transactions, including sales, acquisitions, repayments, and invoices. It is the process of keeping clear and concise documents to make sure that all monetary details is conveniently accessible when required.By frequently upgrading monetary documents, bookkeeping aids businesses. This assists in easily r and conserves services from the stress and anxiety of searching for papers during go to this web-site due dates.

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

They also want to recognize what capacity the organization has. These facets can be conveniently taken care of with bookkeeping.Therefore, bookkeeping aids to prevent the headaches connected with reporting to capitalists. By maintaining a close eye on monetary documents, services can set realistic objectives and track their progression. This, consequently, cultivates far better decision-making and faster service development. Federal government laws commonly need companies to maintain economic records. Normal accounting makes sure that services remain compliant and stay clear of any type of charges or legal concerns.

Single-entry bookkeeping is simple and works ideal for local business with few deals. It entails. This approach can be contrasted to keeping a basic checkbook. Nonetheless, it does not track properties and liabilities, making it much less extensive compared to double-entry accounting. Double-entry accounting, on the other hand, is extra advanced and is typically thought about the.

Stonewell Bookkeeping Things To Know Before You Get This

This might be daily, weekly, or monthly, depending on your business's dimension and the quantity of transactions. Don't hesitate to look for assistance from an accounting professional or bookkeeper if you locate managing your financial records testing. If you are seeking a free walkthrough with the Audit Option by KPI, call us today.Report this wiki page